Military retirement and va disability calculator

23 1996 up to 75 inactive points for retirement years ending on or after Sep. A Veteran who served at any time and has a present service-connected disability or is receiving compensation disability retirement benefits or pension from the military or the VA but does not qualify as a CP or CPS or.

2021 Va Disability Rates Pay Chart Cck Law

The VA Service-Connected Disability rating system is complex not least because of the way the VA calculates final service-connected disability ratings.

. Ten points are added to the passing examination score or rating of. Tips for calculating pay. 2022 Military Pay Charts.

However if a veteran is rated at 50 disability rating or higher and receiving full retirement and full disability the garnishments can only come out of the military retirement pay portion. Concurrent Receipt of Disability Pay lets you get military retirement pay and VA disability compensation at the same time. If the VA disability compensation is the only source for the veterans income credit debts medical debts student loans and taxes cannot be garnished.

Veterans can receive military retirement pay and Social Security. Members percentage of disability determined by the military service. Military retirement is taxable but a VA pension is tax-free.

As always if you have problems you can always call DFAS at 800-321-1080 for help. On the flip side your compensation cannot be garnished if you choose to waive a portion of your military retirement pay. VA Disability Increase Disabled veterans will also get a bump.

The retirees offset for VA benefits is gradually restored by CRDP since it is a benefits phase in. Yes as of the most recent CPI data from July 20 2021 military disability benefits will increase by 59 in 2022. Military retirement benefits are taxable while VA disability benefits and VA pensions are not.

Military disability retirement is different than VA disability because you get it from DOD not VA and VA disability is based solely on an injury or medical condition - NOT the ability to perform. Under these rules you may be entitled to CRDP if you are a regular retiree with a VA rating of 50 or more. By law members may receive credit for up to 60 inactive points for retirement years that ended before Sep.

But a VA pension is based on wartime service and financial need. And the marital share is this equation. 10-Point Disability Preference XP.

The exception for this is if the member is eligible for an offset due to a disability rating of 50 percent or higher or theyre eligible for Combat. Double Bonus Military Retirees Can Receive Retirement and VA Disability Benefits. You are a reserve retiree with 20 qualifying years of service who has a VA.

Each day counts as 130th of a months rate. Its either one or the other or whichever is the higher benefit. The calculation of military retirement if the member is already retired at the time of divorce is simple - Multiply the marital share against the disposable retired pay.

So if your VA disability compensation were 300 a month each day of VA disability compensation is worth 10 per day. Military Retirement Calculation When Already Retired At Divorce. Then compare it to your Drill Pay using the Drill Pay Calculator.

Concurrent Receipt of Disability Pay lets you get military retirement pay and VA disability compensation at the same time. This calculator also takes into consideration taxes so you can see how much your VA disability will be. When it comes to VA Disability Compensation a veteran usually cannot receive VA disability payments in conjunction with any other kind of benefit related to the US.

The VA Disability and Military Retirement Pay Calculator is a tool for military veterans to calculate their VA disability benefits and any retirement pay they may be eligible for. Some people confuse military retirement benefits with a VA pension. Start with looking up your VA service-connected disability compensation rate.

Department of Veterans Affairs or to the military. The VA can garnish your benefits according to Title 38 which states that you must be able to support your dependents. Here are two ways to tell the difference.

2022 Military Pay Charts. The current VA disability pay rates show compensation for veterans with a disability rating 10 or higher. Lets say you choose to waive 25 of your military retirement to receive the non-taxed compensation.

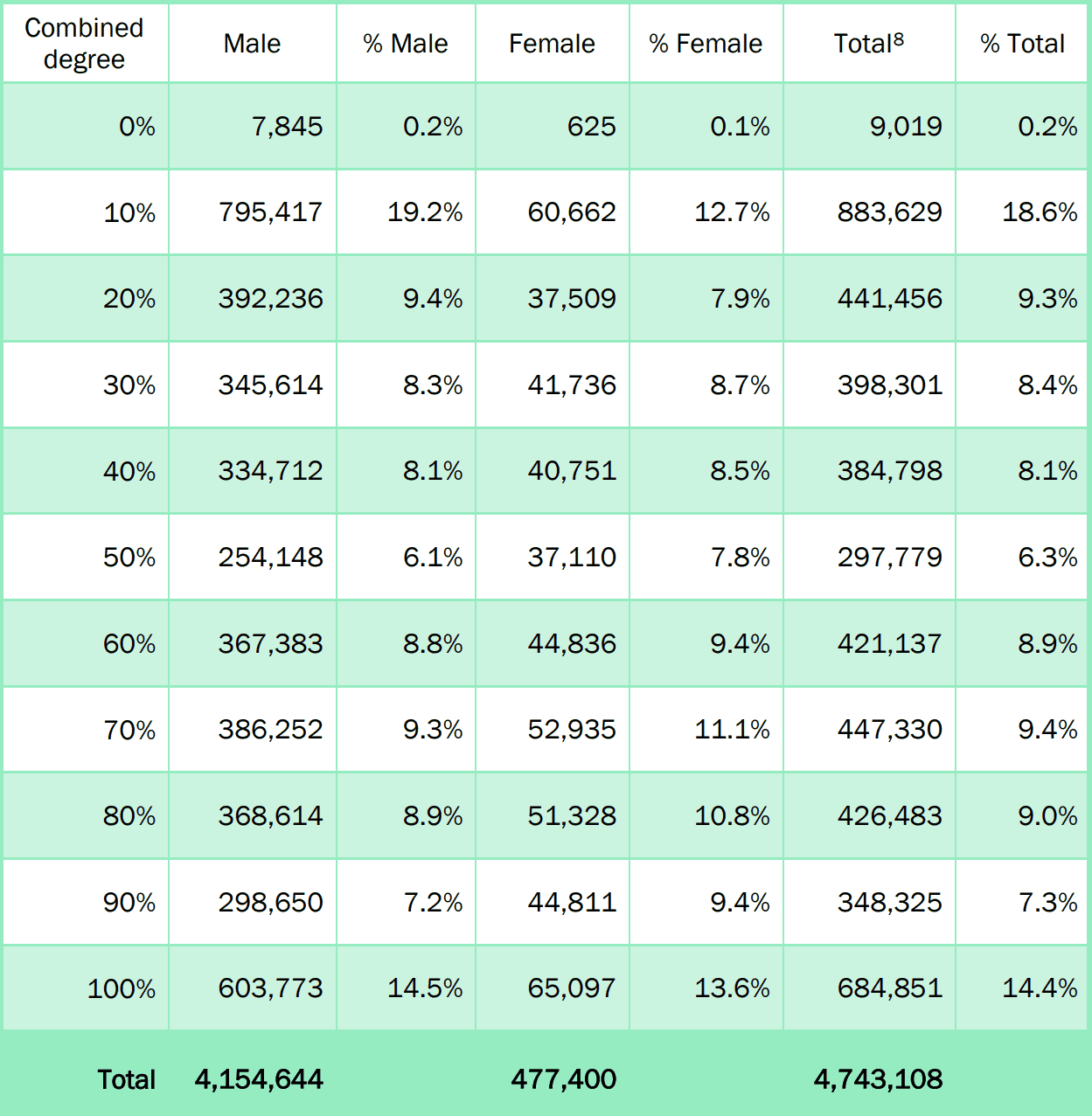

VA Disability Benefits for National Guard and Reservists Posted by Berry Law on February 28 2020 in National Guard Service as a traditional reservist or National Guard member is not active service and does not adequately establish Veteran status which is defined in 38 CFR 31dHowever National Guard and Reservists are still eligible for VA benefits even. Concurrent Retirement Disability Pay CRDP CRDP began in 2004 and applies to military retirees who have a combined VA disability rating of 50 or greater. Military retirement uses years of service not necessarily wartime.

A veteran receiving disability compensation from the Department of Veterans Affairs VA has their military retirement pay reduced by the amount of VA disability compensation they receive. Years of creditable service times 25 or 20 Based on whether the member was a participant in one of the legacy retirement programs or the Blended Retirement System prior to the disability Note that in both cases the multiplier is limited to 75 by law. VA disability ratings determine compensation payments and access to other service-connected disability benefits.

Use our military pay calculator to compute your. Veterans Pension Versus Military Retirement. TSP was created as a retirement.

The average VA disability check will go up about 850 per month for those with a 10 rating and 18565 for those rated at 100. The pay is based on your length of time in service and is calculated at 25 times your highest 36 months of basic pay. The SSA made its official Cost of Living Adjustment COLA announcement with a 59 increase which affects more than 75 million Americans who receive Social Security and Supplemental Security Income SSI benefits VA disability and.

Learning to calculate your rating is important to make sure youre receiving. VA Disability Compensation Rates for 2022 with Example Calculations VA disability compensation pay is a tax-free benefit paid to Veterans with injuries or illnesses obtained during or made worse by active duty. Paper forms may take up to 60 days to be processed.

Military retirement pay after 20 years or more of service. These are the latest VA disability compensation rates for 2022. The military retirees are allowed by the Concurrent Retirement and Disability Pay to receive both Veterans Affairs compensation and military retired pay.

Combat Related Special Compensation CRSC CRSC began in 2008 and applies to military retirees who have a service-connected disability rating of at least 10 that stems from a combat. We cannot provide technical support to help use the calculator however.

Va Math How Combined Va Disability Ratings Are Calculated

2022 Va Disability Calculator Hill Ponton P A

How To Increase Va Disability From 60 To 100 Hill Ponton P A

40 Va Disability Benefits Explained Va Claims Insider

Can You Receive Va Disability And Military Retirement Pay Cck Law

2022 Va Disability Pay Chart And Compensation Rates Cost Of Living Adjustment Cck Law

2023 Va Disability Rates Projected Massive 8 9 Cola Increase Could Be Coming Va Claims Insider

Va Disability Pay Schedule 2022 Update Hill Ponton P A

2020 Va Disability Pay Rates Veterans Guardian Va Claim Consulting

Can You Receive Va Disability And Military Retirement Pay Cck Law

70 Va Disability Rating How To Increase To 100 Ptsd Lawyers

90 Va Disability Benefits Hill Ponton P A

Projected 2023 Va Disability Pay Rates Cck Law

Updated For 2022 Va Disability Rates Charts And How To Calculate

2021 Va Disability Compensation Schedule Bross Frankel

Waive Va Compensation For Military Pay Va Form 21 8951

Va Disability Pay Schedule 2022 Update Hill Ponton P A